EMPLOYEE ENGAGEMENT SCARE TACTICS

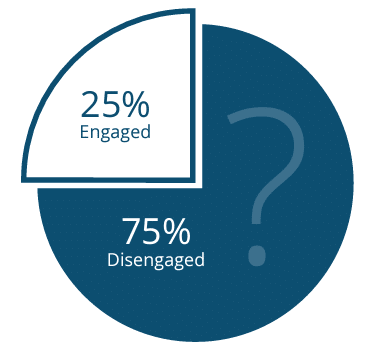

It’s rare these days to pick up an HR publication or attend a conference that isn’t at least partially dedicated to employee engagement. Many of these articles or events begin with alarming—although not always accurate—quotes like “over three-fourths of your employees are actively disengaged, and unlikely to be making a positive contribution to the organization.” Scary.

Employee Engagement Scare Tactic

While most of these statistics are hyperbole (i.e., do you really think an organization can function if seven out of eight employees are either actively sabotaging your company or darting for the exits?), there appears to be little challenge to the idea that an organization’s success is directly tied to the employee experience (EX). Engaged employees are far more likely to deliver results than disengaged employees. Also, few dispute the notion that keeping your finger on the pulse of the organization is critical to business success. The question is no longer one of if an organization should gather feedback but, rather, how that feedback should be gathered.

HOW ARE ORGANIZATIONS MEASURING EMPLOYEE ENGAGEMENT?

For the past two years, consulting firm DecisionWise has surveyed HR practitioners to understand just how organizations go about measuring engagement and the EX. Based on responses from more than 200 companies across the globe (representing over 1.2 million employees), two-thirds of organizations (67%) claim to formally measure employee engagement on a regular basis, and have specific initiatives in place to address their findings. Interestingly, over the past several years, the question of “how often and how should we solicit employee feedback?” seems to have replaced the previous question of “should we solicit employee feedback?” Much of this results from a new wave of technology that allows organizations to gather real-time feedback, as well as to continue collecting more strategic feedback through their traditional annual employee surveys.

85% of organizations indicate that they are either currently measuring the employee experience or have plans to do in the near future.

WHICH EMPLOYEE ENGAGEMENT MEASUREMENT METHOD IS BEST?

There has been an increased push over the past several years to downplay the role of the traditional annual survey, with some recommending instead that feedback be gathered more frequently—even as often as once a day or in “real time.” Further, in a push fueled primarily by survey software providers, rather than HR professionals, some organizations are enticed by technology that allows them to both solicit and provide feedback at any time of the day or night, in real time. On the other end of the spectrum, many organizations still prefer a more traditional approach to surveying their employees, opting instead for an annual or semi-annual engagement survey. However, while most organizations won’t be abandoning the annual survey anytime soon, most agree that an annual check-in with their employees is not enough. It’s simply too infrequent to understand the employee experience (EX).

So, which of these engagement measurement methods is the most effective? More importantly, which of these survey methodologies provides the best information upon which to make critical employee and strategic decisions?

As with most people-related questions, the answer is, “it all depends.” While one solution won’t be right for every organization, it is important to understand the options available before settling on a particular method to use in your organization.

TWO PRIMARY VARIABLES: SCOPE AND FREQUENCY

Although numerous variations are currently available, employee engagement survey solutions generally vary by two main factors:

- SCOPE – Scope refers to the magnitude and depth of the survey (number of employees surveyed, number and depth of questions or items, level of reporting detail and analysis, how the results will be used, ).

- FREQUENCY – Frequency is simply how often the survey will be conducted (annually, quarterly, weekly, always-on, ).

These two main factors, scope and frequency, create four primary types of employee survey options. Remember, numerous variations of these four types exist. However, they can generally be broken down into the following, ordered from most frequent to least frequent in administration:

- Always-on surveys

- Spot surveys

- Pulse surveys

- Anchor surveys

While various survey providers may use different names and features, these four types listed above generally cover the range of variations and options.

ALWAYS-ON SURVEYS

FREQUENCY: HIGH

SCOPE: LOW

Always-on or continuous feedback technology provides “real-time feedback” that can be quickly deployed and reviewed. These surveys are typically used in two ways:

- Ongoing feedback to the company and/or for performance feedback (including reward and recognition). They generally ignore organizational structure, meaning that due to anonymity, results don’t typically roll up under departments, functions, or specific When used for company feedback, these platforms act as a modern-day variation on the old suggestion box. When used for performance purposes, real-time feedback for colleagues, bosses, subordinates, and others can be provided with just a few taps of the screen. Surveys can address guided questions, which are to be evaluated on a Likert scale (“How likely would you be to recommend XYZ Company to friends, based on today’s experience?”), specific topics (“Have you had a performance conversation with your manager sometime in the past week?), or even as general open-ended comments (“What would you like us to know about your experience?”).

- Another option that has recently gained attention is an unstructured feedback option: The ability to comment on anything, at any time (a modern take on yesteryear’s suggestion box).

Pros

The most obvious benefit of always-on surveys is speed. Employees can quickly provide feedback, and often this type of survey allows employees to address nearly any topic, whether the survey tool asks for it or not. When enough employees participate, always-on surveys can identify hot-spots (whether good or bad) within an organization. These surveys are relatively simple and initially inexpensive to deploy, don’t require extensive technology, and are based on many of today’s feature-rich, software deployment systems. Perhaps most important, they provide employees the opportunity to feel that they have been heard. Often called “active listening” or “continuous feedback,” the intent is that these surveys give employees opportunities to tell the organization what they feel is important—whenever they want.

Cons

When DecisionWise first began deploying always-on surveys (about ten years ago), we admittedly thought they might be the wave of the future. However, we learned two things: being fast doesn’t always equate to quality, and contrary to what we saw in the movie, Field of Dreams, just because “we build it doesn’t mean they will come.” Some HR professionals and managers assume that, because the software will allow a certain survey methodology, employees will embrace it, and feedback will come pouring through the technology platform. Unfortunately, that’s rarely the case and, if it is, it generally doesn’t last long (more about this later).

These types of surveys fall under what industrial/organizational psychologists refer to as “sentiment surveys.” In other words, they are good at gauging feelings in a particular moment of time, whether that be positive or negative sentiment. One problem is that real-time surveys often deal in extremes (I’m either really happy or really ticked off when I respond), rather than providing a more tempered, more consistent representation. Comments are often based on localized information and line of sight, rather than applicable to the entire organization. We have found that, as with most new technology, employees find this method interesting and even refreshing at first, but excitement tends to die out over time (as does the amount and quality of feedback). Additionally, while they’re reasonably inexpensive to initiate, this type of always-on survey can become quite costly over the long run, often exceeding the costs of more conventional surveys.

ALWAYS-ON SURVEYS ARE GOOD SUPPLEMENTAL TOOLS

Always-on Surveys are effective if used properly and as an aid to more robust surveys. They can also serve as quick, effective recognition mechanisms. Immediate feedback is appealing, simple, and helpful in taking action.

One of the most attractive selling points for always-on surveys is that they promote the ability to take quick action. While the promise of having real-time data upon which to take action is appealing, many managers and HR functions find the information from these systems insufficient to give a complete picture. These tools have their roots in the customer service field, where immediately resolving an individual customer concern (replacing a defective product or replacing an overly salty meal, for example) is a top priority. However, where effective customer service means resolving individual concerns quickly and individually, employees prefer anonymity and confidentiality when giving feedback about their organizations, peers, and bosses. Further, unlike customer surveys, acting on each employee’s unique feedback is neither prudent nor feasible; immediately replacing a customer’s meal when there’s a problem is much more practical than immediately replacing her boss when she doesn’t like him.

ALWAYS-ON SURVEYS FOR MANAGERS AND THEIR TEAMS

A recent trend within many organizations is to use always-on surveys as a tool exclusively for managers, either as a performance management tool or as a general “state-of-my-team” assessment, rather than at the organizational level. In this case, a team’s manager will receive ongoing feedback, which may or may not be rolled up and monitored at an organizational level. While this may appear to be a great idea in theory—any good manager would support the value of ongoing feedback—the reality is that many managers will simply do little, if anything, with the results. On the opposite extreme, we have seen some managers become resistant to the results, either openly or quietly, which brings its own set of problems.

It’s also important to remember that not all employees will have immediate and reliable access to the survey technology while at work (computers with internet access, surveys kiosks, etc.), or choose not to participate in surveys using their own personal devices. Mobile accessibility (smartphones, tablets, voice response, etc.) has become common for this type of technology, yet some employees are hesitant to provide feedback via their personal devices.

In some organizations, managers may also use this technology as a “replacement” for holding much-needed conversations, and some employees may hide behind the anonymity as a replacement for providing feedback where it could be best heard and addressed. Along these lines, a developing trend is to promote this survey methodology for use in performance management, often with the intent to replace performance evaluations or appraisals. Although, not the primary focus of this article, the notion of using technology for ongoing performance feedback is a matter of continued debate and discussion within organizations today.

Less than 3% of those organizations participating in our research indicated that they intended to replace the annual survey with always-on technology.

While it may seem good in theory—only providing performance feedback every twelve months is far from effective—this type of feedback suffers from the same cons listed above. In particular, employees report that the feedback is highly superficial and rarely incorporated into a beneficial development plan.

Cool? Yes. Useful? Probably. From what we have experienced, and what we’ve learned from hundreds of organizations, always-on surveys are a good addition to the employee feedback arsenal, but simply don’t replace the rich depth provided by an annual (or “anchor”) survey, despite what many technology vendors might claim.

SPOT SURVEYS

FREQUENCY: LOW

SCOPE: LOW

Similar to an always-on survey, spot surveys are also generally quick to deploy, address sentiment rather than engagement, and do not require (or allow for) in- depth analysis. They are often designed to address specific events (a conference), areas (benefits), or issues (a recent downsizing). Spot surveys are rolled out to measure current hot topics pertinent to the organization, such as gathering input about a change in benefits or soliciting opinions from employees. For this reason, industrial psychologists group spot surveys under the “polling and opinion” category.

Spot surveys are fairly simple to launch or to roll out, and many survey software platforms allow managers or other users to design and administer their own surveys. In this case, these platforms are purchased as applications that may reside on local desktops or are made available through an online application software-as-a service (SaaS)-licensed model (the latter has overtaken the former as far as popularity).

Other systems are geared more to administration by HR personnel, allowing them to get a feel for the thoughts or opinions of employees. Many organizations find that, rather than purchasing extensive software to run these assessments or hiring an outside firm to design and administer the survey, free off-the-shelf survey systems may meet their needs. Other organizations that have purchased software or have enlisted a survey provider for their needs find that spot surveys are a convenient part of the overall feedback package. Well-designed software platforms have more functionality and options than do the no-cost survey applications available for use on the internet, although their general purpose is very similar.

Pros

Spot surveys are effective at soliciting specific employee opinions or thoughts without requiring an extensive surveying effort. They are generally cost-effective, and some companies find free options meet their short-term or one-off needs for very simple projects. When such surveys are properly designed, data received from these surveys provide an organization or team with very specific information upon which to take targeted action.

There is a side benefit that is perhaps more prevalent with spot surveys than with other surveys, although it does carry over to all surveys: the simple act of requesting feedback or opinions says to recipients, “We care about what you have to say about XYZ, and we’re listening.” This, in a sense, has its own engaging effect—people want to feel like they are heard and that they are being asked.

Cons

Spot surveys carry some disadvantages. Perhaps the greatest of these is exemplified in what the U.S. witnessed in the last presidential election. Polls continually showed Donald Trump lagging Hillary Clinton in votes—often by a significant margin. You know the rest of the story. Regardless of your political views, the fact is that polls didn’t actually predict the outcome of the election. Similarly, using a limited set of data to extrapolate what is going on with the employee experience can be misleading.

THE ART AND SCIENCE OF SURVEY QUESTIONS

The ease of use and low cost of administration of spot surveys can also be disadvantages. Some managers, and even some HR professionals, don’t fully understand that there is both art and science that goes into asking the right questions or designing a survey. We’ve seen some pretty bad surveys designed by people who thought they were doing the right thing. While poor survey design is not limited to just spot surveys, we have found them to be more susceptible to bad design, due to their ease and accessibility to those who are untrained in survey principles. It’s also important to remember that spot surveys typically don’t consider organizational structure and hierarchy (who reports to whom, etc.), so a comprehensive analysis of the data is limited. Unfortunately, even in the best-case scenario, the result of a bad, incomplete survey is bad information. In the worst, actions taken as a result of this bad information can be counter to what really needs to be done.

SPOT SURVEYS WORK LIKE POLLS

Spot surveys, as with each of these surveys, are effective tools when used properly. They provide useful information about specific areas of concern, as well as general opinions. They can be effective at charting progress, as progress can be gauged from one point in time to another.

Essentially, spot surveys work like polls and therefore have similar advantages and disadvantages. First, the survey is only as good as the questions asked. Second, keep in mind that they, like their always-on counterparts, provide insight into only a limited set of data. Making decisions and assumptions based off this limited view can be quite costly.

PULSE SURVEYS

FREQUENCY: HIGH

SCOPE: HIGH

Many organizations and survey software providers use the terms “pulse survey” and “always-on survey” (or variations of always-on, such as “continuous feedback” or “real-time feedback”) interchangeably. While this makes sense on the surface (there is always a survey going on, even if this may be at monthly or quarterly intervals), pulse surveys are technically more similar to anchor surveys than to true always-on surveys.

PULSE SURVEYS VS. SPOT SURVEYS

Called “pulse” because they “take the pulse” of an organization or group, these types of surveys are helpful tools in gauging progress, warning of potential dangers, understanding trends in the employee experience, and promoting action. Pulse surveys share many similarities with spot surveys, but with two key differentiators:

- They occur at regular or planned intervals, or with planned groups, and generally involve large pockets of the organization’s population (if not all employees).

- Pulse surveys are often intentional follow-ups or supplements to other surveys.

Pulses sometimes ride the coat tails of anchor surveys or other pulse surveys, in that they serve as a great way to drill down for more specific information or follow up on areas that need to be addressed. For example, if an employee engagement survey occurs each year, and results clearly show managers aren’t taking the time to give employees regular feedback about their performance, the organization may put into practice processes that encourage managers to provide frequent feedback.

Rather than waiting for the next annual or semi-annual anchor survey to understand whether these actions have been effective, a pulse survey could be administered each month or each quarter that gets at that specific question set, as well as other critical items identified by the anchor survey.

We have found that many organizations use their anchor surveys (more about these surveys later) to identify 3-5 specific actions that need to be taken to improve the employee experience. They put plans in place and send out a brief (generally fewer than 10 questions) quarterly or monthly survey to gauge progress. The key to understanding the usefulness of these surveys is the word sub: a sub-group; a sub-set of the population; a sub-set of the anchor survey; etc. Pulses are able to take the value obtained from the anchor survey and break it into smaller, more actionable chunks so that actions can be taken. However, due to the limited length of the survey, pulses may not provide the insight organizations need if they are used as stand-alone surveys (absent a more comprehensive anchor survey).

ARE PULSE SURVEYS SUFFICIENT?

Along these lines, some organizations find that their levels of employee engagement are solid year-over-year, and their subsequent action plans are appropriately focused on “continue doing what we’re doing.” Rather than administering an annual anchor survey, their objective is to watch for warning signs before they become problems, as well as to look for pockets of future concern—issues with a department or manager, concerns within a segment of the population, or potential attrition. They find value in the ability to administer less extensive surveys more frequently to sub-sets or samples of the overall population. In this case, the pulse survey acts as a warning gauge, much like a warning light on a vehicle dashboard. Over the year, most (or all) of the population will have been surveyed. While our research found that most organizations (87%) conducting pulse surveys still rely on an annual anchor survey for more extensive analysis, others (13%) find that pulses alone are sufficient.

PULSE SURVEYS GATHER TARGETED INFORMATION ABOUT EMPLOYEE LIFE CYCLE

Another popular use of pulse surveys is to gather targeted information about experiences across the employee life cycle (ELC). This includes gaining an understanding of such ELC events as an employee’s hiring or onboarding, transition from individual contributor to supervisor, or exit from the organization. This targeted approach reaches most employees at critical parts of the ELC, rather than conducting a broader survey with all employees at the same time.

Pros

Pulse surveys are effective mechanisms for determining progress on specific initiatives undertaken as a result of a larger survey or experiences across the ELC. In this sense, they provide the advantage of always-on surveys (frequent response), without sacrificing the quality of information received. By comparing the results of one survey administration to another, an organization can effectively measure whether change has occurred, and whether the actions taken get results. They are also effective as check-ins, warning indicators, or, as the name suggests, to simply keep a finger on the pulse of the organization.

Pulse surveys are typically less expensive per administration. Because they are generally based on the same technology system that supports the organization’s more traditional anchor surveys, they can be fairly simple to administer. These surveys can get very specific about items identified by the anchor survey and, because they are surveying the same general population (or sub-sets of that population), can identify changes or trends in specific manager groups, teams, functions, or divisions.

Cons

Pulse surveys are often used for following up on critical items, such as events across the ELC, or issues identified by an anchor survey. In conducting the survey, an organization is telling its employees, “We heard what you said and care enough to see how we’re doing on this.” But, the message the employee hears is, “The company intends to act on the feedback we provide, so we can expect to see some changes.” While this is all very positive for the organization inclined to act on the feedback, a company that continues to survey on issues previously identified, but does little to create change, can be doing more harm than good.

SURVEY FATIGUE

Another risk with pulse surveys—one that is less pronounced here than with always-on or spot surveys—is the possibility of survey fatigue. Surveying too frequently, particularly with little or no action in between, is more detrimental than not surveying at all. Balance is key.

While pulse surveys are effective in assessing segments of the population across intervals, they do not provide the richness of actionable data provided by an anchor survey. Much of this is due to the notion that these surveys are much shorter, and that an entire employee base is usually not surveyed at the same time.

PULSE SURVEYS ARE GAUGES OF PROGRESS

Pulse surveys are excellent, systematic gauges of progress. When paired with other survey methodologies, pulses can be effectively used to measure progress and key areas within the employee experience. From an employee standpoint, when action is taken, the team can see that the organization took the feedback seriously and is actively working to create a more positive EX. The organization gains a clearer picture about hot spots—both positive and negative—and can better tailor actions based on that feedback. However, the frequency of these surveys can also be a drawback, if not used effectively.

TOO FREQUENT CAN EQUAL LACK OF TRUST

While not limited to pulse surveys, surveys that are administered within short time frames (three months or less) may not allow for enough time to show employees their feedback is taken seriously, and that it is being used for change. This may result in lack of trust in the organization’s commitment to change. Further, changes in statistical data from one time period to another (quarter to quarter or month to month) may be small, and it is difficult to say whether these changes are due to intentional action or simply due to minor (and statistically expected) variance in the data. This is a bit like stepping on the scale every day and expecting big changes (and when you do see a change, you are reminded that weight can fluctuate by 5 lbs. in any given day!). As you can imagine, this drawback would also apply to always-on surveys. As with any survey, pulse surveys should not be administered any more frequently than you have the ability to implement action plans.

PULSE SURVEYS ARE NOT COMPREHENSIVE

Pulse surveys have gained increasing popularity, due to their ability to work with more comprehensive surveys, their quick setup and administration, and the ability to provide additional analysis of specific information. However, pulse surveys should not be considered comprehensive, in that they are limited in the number of questions/items addressed, or the groups being surveyed. When used to gather information through the ELC, the data should be considered as input into understanding the overall employee experience. When used to gauge progress on initiatives, they supplement the more traditional anchor survey.

We recommend using the same technology for pulse as is used to administer anchor surveys. Doing so will save time in determining the organizational structure (departments, functions, who reports to whom, etc.) to be used in reporting survey results. It will also allow a direct comparison of results from one survey administration period to another, without increasing the difficulty of working with multiple systems.

ANCHOR SURVEYS

FREQUENCY: LOW

SCOPE: HIGH

When most companies talk about their annual employee survey, they are referring to an “anchor survey.” These surveys have been used for decades. Our research found that 89% of organizations use anchor surveys (in some form or another) and, of those, only 6% said they would be moving away from anchor surveys in the foreseeable future. Despite what some software providers might advertise, this type of survey is likely to be a part of gathering feedback for most organizations for years to come. Why? Most organizations simply find that, when implemented correctly, they work.

THE TRADITIONAL EMPLOYEE SURVEY

Anchor surveys carry many different names: employee engagement survey, employee survey, well-being survey, climate survey, employee satisfaction survey, employee experience survey, culture survey, and so on. While there are actually differences between each of these types of anchor surveys, that’s a discussion for another day. However, they all fall under the category industrial/organizational psychology refers to as “anchor surveys,” due the fact that they presumably form the base around which other surveys operate.

Over the past two years, an increasing number of survey technology vendors have attempted to downplay the role of anchor surveys in understanding employee feedback. Some of the reasons these providers give are accurate; the most often- cited being frequency—anchor surveys are designed to capture feedback at 6-month, 12-month, or 18-month time periods, rather than continual organization feedback. Of the more than 200 organizations replying to the DecisionWise 2017 State of Engagement Survey, 55% of those conducting anchor surveys do so annually, 6% every 18 months, 18% every two years, and the remainder roll out anchor surveys with varied frequency.

Pros

While the frequency of the anchor survey is held up as a disadvantage by survey software companies, it is also one of the most significant advantages of these surveys.

First, rather than capturing sentiment or employee views during a specific snapshot in time, as with more frequent surveys, a well-designed anchor survey gathers longer-term feedback, assessing an employee’s level of engagement over an extended period. Statistically, this tends to be a much more reliable representation of what is truly going on within the organization.

Second, a less-frequent (annual or semi-annual) survey avoids one of the biggest drawbacks of an always-on survey—rater fatigue and indifference. An anchor survey is, for want of a better word, an “event” that occurs at a set interval. It is administered only once during that time period, meaning it is less time-consuming for the employees—something particularly important when “time is money.” It is usually accompanied by communication around the survey, and all employees are very much aware of the survey. This greatly increases the level of survey participation (we have found organizations can expect response rates of 75% or higher). Executives, as well as managers at all levels, become more involved in the findings when results are presented less frequently than in the case of an always-on dashboard. Although we would like to think otherwise, with more frequent surveys, managers simply get tired of looking at survey results monthly or in “real time.”

In contrast, with an annual survey, organizational leaders tend to be much more focused on the results.

55% of those conducting anchor surveys do so annually, 6% every 18 months, 18% every two years, and the remainder roll out anchor surveys with varied frequency.

RESEARCH-BASED AND STATISTICALLY SUPPORTED

Another significant advantage of anchor surveys is that they facilitate greater analysis. Because survey questions/items are much more structured, the results from these surveys allow for more statistical rigor. Statistical analyses with an anchor survey are far more robust than surveys of a smaller score. Analyses such as multi- variate correlations, multiple regression analysis, engagement indices, potential attrition analysis, engagement migration analysis, and so on, can both identify current states of engagement on multiple levels, as well as use predictive analytics (we’re hearing the phrase “artificial intelligence” being inaccurately tossed in more frequently these days) to identify what levers to pull to enhance the employee experience. While always-on surveys provide interesting, although very limited information at a specific moment in time, they fall far short of the rich data offered by anchor surveys.

Data from a survey itself is valuable, but information that allows action to be taken is the true advantage of any survey, regardless of its frequency or scope. Anchor surveys are inherently strong in this area and are more likely to be an impetus for results than any other survey type. Along these lines, these surveys provide very effective input into strategic decisions, rather than trivial information, such as whether employees like the new latte machine on the second floor.

Cons

As survey software vendors rightly point out, the two disadvantages of anchor surveys are their infrequency and the heavy degree of administration associated with the survey. Anchor surveys allow organizations to break down results on many different levels, such as job tenure, department, manager, function, education level, gender, job title, and so on. Robust survey systems can “code many of these demographics on the back end,” meaning they don’t have to ask employees to provide this information—it’s already linked to their survey responses, while still maintaining confidentiality. Though a tremendous advantage when it comes to actionable data and analysis, this also means that an organization needs to have a clear understanding of these demographics and “clean data” from the human capital information systems. Some organizations we have worked with in the past simply don’t have an effective way of tracking employees by departments or other categories. While this is not a problem with the survey methodology itself, the quality of the demographic information going into the survey administration greatly impacts the ability to accurately report findings. You know what they say: “garbage in, garbage out.”

THE NEED FOR EXPERTS

Because this survey is conducted all at once, rather than ongoing, much of the effort takes place in a one-time burst. This can incur some costs. As these surveys tend to be fairly large undertakings, depending on the size of the organization and extent of the survey, expenses for these surveys obviously cost more than do-it-yourself freeware. Many organizations we have worked with have purchased or licensed software to conduct their anchor surveys. While that works with organizations that have the internal resources to administer and analyze these surveys, most companies quickly find that they are in over their heads (we were once called in to work with a company that had nine full-time employees who did nothing but administer and analyze the company survey!). Keep in mind that, in addition to experts in administering the survey, an organization would also need experts in psychometrics, as well as action planning, in order to get the most out of a survey.

These valuable resources are not plentiful in organizations where human resources departments aren’t resource-rich. Most companies find outsourcing the survey process more effective than purchasing survey software, although costs can add up. Don’t be fooled into thinking, however, that administering a survey inside an organization won’t eat up valuable time and resources.

IS ANNUAL FEEDBACK INSUFFICIENT?

Critics of anchor surveys are quick to point out that gathering feedback yearly is insufficient. They are correct, which is why we recommend supplementing anchor surveys with other types of surveys.

On their own, anchor surveys can provide a rich view of the current state of the employee experience. They form a base from which to take action, and are valuable input into the status of what most organizations find to be their most expensive (and most important) resource—their people.

The information received from anchor surveys is far more comprehensive than that received from more frequent surveys. Data can be cut many ways, and predictive correlations can be drawn in order to understand how action in one area will impact another area.

We see an increasing trend to connect anchor survey results with business metrics. For example, one healthcare organization we recently worked with had analyzed the correlation between engagement and factors such as attrition, submission of employee medical claims, risk for chronic conditions, occurrence of unscheduled absences, workers’ compensation claims, relationships with peers and managers, patient satisfaction, and even recurring infection rates in patients. This type of analysis isn’t as valuable (if even possible at all) using surveys of lesser scope, such as always-on feedback. More advanced survey technology also allows for the gathering, storage, analysis, and comparison of multiple survey administrations.

MAKING YOUR SURVEY SUCCESSFUL

Our firm has been both using and administering surveys for more than 20 years. During that time, we’ve seen all kinds of survey methodologies and technologies come and go. Some are very effective; others are just new twists on an old trick. When asked what we recommend, we go back to the statement, “It depends.” The best survey is the one that helps your organization be successful. Although newer, shinier, and full of a lot more convenient bells and whistles, some of these “new survey technologies,” as well as their accompanying pros and cons, have existed in some form or another for decades. Today’s versions are more useful and practical, but still carry many of the same advantages and disadvantages.

6 RECOMMENDATIONS TO CONSIDER FOR YOUR EMPLOYEE SURVEY

Regardless of the engagement measurement method or tools chosen, consider the following recommendations when determining your employee survey philosophy:

- Remember that the purpose of the survey is to make the organization more successful, not simply to gather data. Its primary goal should be to understand how to align the employee experience with the goals of the While some surveys provide interesting data, they do little to support the organization’s strategy. Your survey process will be successful if it allows the organization to gather and act upon information that makes the company more successful.

- Think of the survey as a campaign, rather than an event or series of A campaign is long-term, and has a purpose. Engagement doesn’t start and end with a survey. The survey should be part of a larger process to address the whole employee experience. Survey data provides excellent information that can be integrated with other performance data (Do engaged employees lead better? Is our quality better on the assembly lines where employees are most engaged? Are our engaged salespeople generating the greatest amount of revenue? Is our customer experience better in departments where the employee experience is strong?).

- Beware of assessment technologies or providers whose focus stops on one end of the survey spectrum (always-on versus anchor; simple versus comprehensive) in favor of exclusively using the other. An integrated approach that gathers feedback in several ways is most effective.

- Technology isn’t the answer—it provides data upon which to act. Don’t let the technology drive the Organizations can get caught up in the capabilities of a survey software system and technology. However, survey technology doesn’t change the employee experience, regardless of how many bells and whistles it may have, how cool it is, or how much the salesperson tells you Millennials get excited about new technology. The tried-and-true organization development concepts of “measure, act, and re-measure” are what create the change—not the technology.

- Reconsider the do-it-yourself While administering a survey using only internal resources may be useful and practical (free online survey software to survey a department of 10 about what they thought of the company party, for example) is a do-it-yourself project. But surveying an organization of 50,000 (or even 50) may be best handled through the expertise and dedication of an outside firm.

- Most importantly, only survey as often as you are prepared to act. Let this statement be your guide when it comes to If your organization doesn’t have the capacity or intent to act on a monthly survey, don’t survey monthly. If you don’t intend to follow up continually on an always-on survey, don’t use an always-on survey. Nothing says, “We don’t care” like receiving feedback and not taking action. The pace at which your organization can act should dictate the frequency of your survey.

We recently completed extensive research for our book titled, The Employee Experience: How to Attract Talent, Retain Top Performers, and Drive Results. In our research, we found a number of organizations that are doing things right when it comes to their employees (and some that just don’t get it). We find two common factors inherent in organizations that understand the value of their employees:

- They understand that it’s their employees who drive the success of the

- They gather and act on feedback to constantly enhance the

So, which employee feedback process is best? You guessed it— it depends. Regardless of the differing methodologies used, however, listening and taking action are keys to the employee experience.

RETHINKING THE EMPLOYEE SURVEY

- Your survey process is successful when it makes the organization more successful

- Think of your survey as a campaign rather than an event or series of events

- An integrated survey approach, using several feedback-gathering methods, is most effective.

- Don’t let the technology drive the

- Reconsider the do-it-yourself

- Only survey as often as you are prepared to take action